If you’re considering the Portugal Golden Visa, one of the essential steps is learning how to open a bank account for Portugal Golden Visa, which also requires obtaining a Portuguese Tax Identification Number (NIF).

While we’ve already covered how to get an NIF in a previous article, this guide will focus on the process of opening a bank account. We’ll also explain the list the necessary documents you’ll need to provide.

Table of Contents

ToggleHow to Open a Bank Account as a Non-Resident in Portugal

Before making an investment under the Portugal Golden Visa program, you’ll need to know **how to open a bank account for Portugal Golden Visa** with a Portuguese bank.

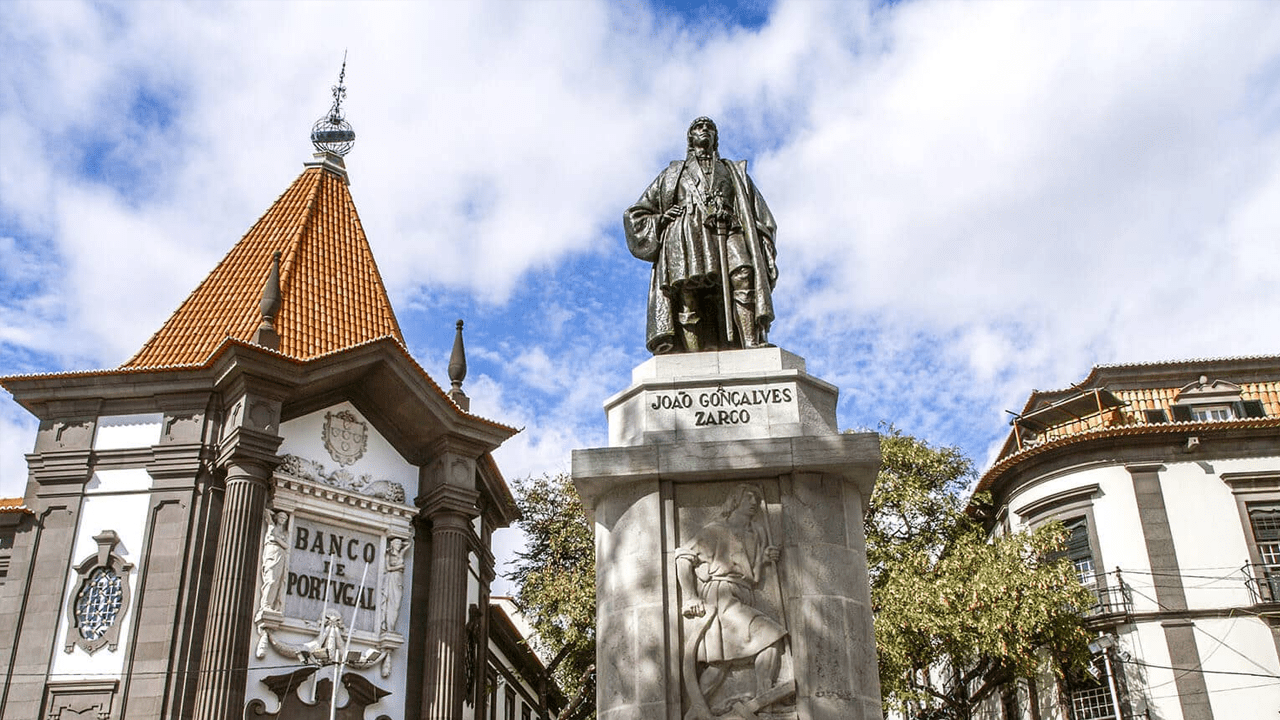

Any bank authorized by the Central Bank of Portugal can process your account request, including well-known institutions like Millennium BCP, Caixa Geral de Depósitos, Novo Banco, and Banco de Investimento Global.

To get started, you’ll need to provide the bank with the following:

- Passport details

- Financial information

- Your Portuguese taxpayer number (NIF)

- Contact details of your representative in Portugal

After submitting these details, the bank will conduct a background check to ensure you have no criminal record, aren’t listed on any sanctions lists, and haven’t been involved in tax evasion. These checks are standard requirements for opening a bank account in Portugal.

Once the background check is complete, you’ll need to provide:

- Your fingerprints

- A signature card

This marks the final step in opening your account.

Can You Open a Bank Account Remotely or Through a Lawyer?

How to open a bank account for Portugal Golden Visa depends on your specific situation and the bank’s requirements. Opening a Portuguese bank account can be done remotely or with the help of a lawyer. Some banks allow non-residents to open accounts online, while others may require in-person visits or the assistance of a legal representative.

If you choose to use a lawyer, they can assist you with the process and may even open the account on your behalf with a power of attorney. However, it’s important to know that a lawyer cannot open the account in your name directly; they can only act as a representative with your permission.

Step-by-Step Process to Open a Bank Account

1. Obtain Your Portuguese Tax Number (NIF)

Before you can open a bank account, you’ll need an NIF, which you can apply for online or at a Tax Authority office. The documents required typically include a valid passport and proof of address.

2. Choose a Bank

Next, research banks in Portugal to find one that fits your needs. Consider factors like services, fees, and branch locations. Some banks offer online banking options, while others require visits to a branch.

3. Gather Necessary Documents

Once you’ve chosen a bank, gather the necessary documents, including:

-

- A valid passport or national ID card

- Proof of income (e.g., payslips or an employment contract)

- Your NIF number

- A mobile phone number for verification

4. Visit the Bank or Use Online Banking (if available)

You or your lawyer can visit the bank branch with all the required documents. The bank representative will guide you through the process. If online banking is an option, you may be able to complete the application remotely.

5. Complete the Application Form

Whether in person or online, you’ll need to fill out an application form. Be prepared to provide personal, contact, and financial information, as well as details about the purpose of your account.

6. Provide Identification

You may need to show original documents for verification, such as your passport or national ID. Some banks may also ask for additional identification, like a driver’s license.

7. Wait for Account Activation

Once approved, your account will be activated, and you’ll receive your bank account details, including your account number.

Additional Benefits of a Portuguese Bank Account

Opening a bank account for Portugal Golden Visa comes with several benefits:

Easy Access for Non-Residents:

Unlike in many countries, Portugal’s banking system is generally accessible to foreigners. While recent regulatory changes have slowed down the account-opening process due to stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, it’s still relatively straightforward compared to other EU countries.

Seamless Euro Transactions:

Portuguese bank accounts are linked to the SEPA network, allowing for free or low-cost euro transfers within EU member states. This makes managing finances in the eurozone simple and affordable.

Low Fees:

Many Portuguese banks offer accounts with low or no monthly fees. Some accounts come with zero monthly charges and free eurozone transactions. For international transactions, some accounts offer competitive fees and convenient online services, which is ideal if you plan to use your account outside the eurozone.

Access to a Variety of Financial Services:

Portuguese banks offer a wide range of financial services such as personal loans, credit cards, savings, and investment options. Having a local bank account makes it easier to access these services when needed.

Convenient Money Management:

With a Portuguese bank account, you can easily manage your funds online through advanced digital banking services. Modern banking apps allow you to make payments, transfers, and manage your investments from anywhere.

International Bank Cards:

Many Portuguese banks offer international bank cards that can be used worldwide. These cards, which are often part of the Portugal Golden Visa program, come with benefits like fraud protection, convenient online shopping, and low currency conversion fees, making them ideal for international travelers.